Subscribe and Get a Free Copy

Enter your details below to subscribe for free to our newsletter.

Enter your details below to subscribe for free to our newsletter.

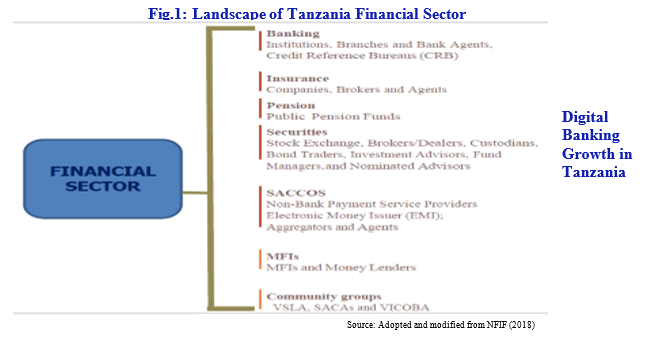

Financial sector in Tanzania is comprised of banks, which accounts for about 70% of financial sector assets (NFIF, 2018); insurance companies, pension funds, Savings and Credit Cooperative Societies (SACCOs), credit companies and moneylenders, and community groups.

The financial sector is wholly regulated after the enactment of Microfinance Act, 2018. The Bank of Tanzania is vested with powers to regulate and supervise all deposit taking financial institutions and some non-deposit taking financial institutions as provided in the Bank of Tanzania Act, 2006; Banking and Financial Institutions Act, 2006; Foreign Exchange Act, 1992; National Payment Systems Act, 2015 and the Microfinance Act, 2018.

Other regulated and supervised financial institutions include bureau de change, leasing companies, mortgage refinance company, microfinance service providers (Tier 1: Deposit-taking microfinance institutions and Tier 2: Non-deposit taking microfinance institutions including individuals and moneylenders), credit reference bureaus and payments systems. Tier 3 SACCOS and Tier 4 community groups supervision and regulation role is delegated to Tanzania Cooperative Development Commission (TCDC) and President’s Office Regional Administration and Local Government (PO-RALG), respectively and they ensure that the supervised institutions abide to the legal requirements.

Digital Banking Growth in Tanzania

Tanzania has 31 regions (26 in Mainland and 5 in Zanzibar) and the banks’ branch network has been increasing. The concentration of the branches is in five regions (Dar es Salaam, Mwanza, Arusha, Mbeya and Kilimanjaro), accounting for 52% of total operating branches (Bank of Tanzania, 2020).

The digital revolution has not left the banking sector untouched. Technology has changed the entire landscape of the financial services sector. From mobile banking to Artificial Intelligence (AI), the digitization wave has compelled the global banking sector to redefine its traditional approaches.

Tanzanian banks have embraced digital banking services well through various channels, including Automated Teller Machines (ATMs), Point of Sale Devices (POS), Internet banking and mobile (SMS). The number of ATMs reached 2,058 from 1,361 in a span of eight (8) years (2012-2020), while that of POS increased to 47,496 from 1,910 (BoT, 2020).

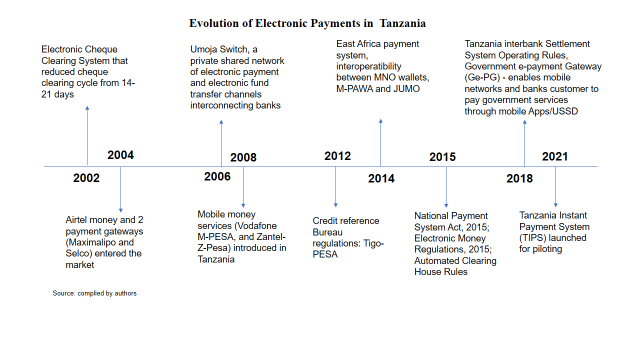

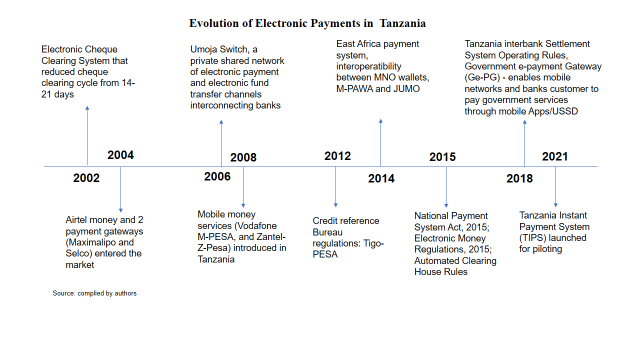

Digital financial sector has grown rapidly since mobile money was first introduced to the country in 2008, largely thanks to innovations leveraged in mobile phone technology, an enabling regulatory environment and a competitive market. Since then, with digitalization and adoption of technology, Tanzania has witnessed significant transformation in access and delivery of financial services.

The value of mobile banking and internet banking transactions have exhibited an upward trend as the value of Internet Banking grew from TZS 17.8 trillion in 2012 to TZS 64.9 trillion in 2020, whereas that of mobile banking stood at TZS 25.0 trillion from TZS 302 million. In 2009, 55% of the Tanzania’s population were financially excluded from financial services, while in 2017, only 28% of the population had no access to financial services (NFIF, 2018).

Further, according to the data from the Bank of Tanzania, the proportion of bank customers using digital banking services in Tanzania has soared from around 15% in 2018 to nearly 50% in 2023. Banks like CRDB Bank, National Microfinance Bank (NMB), and Equity Bank Tanzania has launched various digital services, including mobile banking, online banking, and USSD code-based services.

The Tanzania mobile money market characterized by different types of transactions, including transfers and withdrawals, P2P, B2G, C2B, G2P and P2G payments and deposits. The P2P and P2G transactions are common, facilitated by the stand-alone mobile network operator (MNO) mobile money platforms or platforms interfaced with banks and/or private and government electronic platforms. Remarkable change is the transition from P2P to merchant payments (B2P), small volume payments to bulky payments, and emergence of fintech that use mobile and bank systems to enable international transfers. Factors such as: client trust on the current technology, platform integration and interoperability, have contributed to the rapid evolution of the Tanzanian financial system.

Influence of Mobile Phone in Banking Sector

The use of mobile phones in facilitating transactions in traditional financial institutions, particularly banks, is growing with majority of banks interfacing their core banking systems with mobile network operator’s systems (aggregators of mobile customers information), National Identification database (a recent move) and credit reference systems.

Banks have with their own fintech solutions or collaborate with fintech companies to offer the services. There is tremendous growth of mobile banking transactions, which grew from TZS 57 million in 2008 to TZS 24,973.3 billion in 2021. There are six mobile money telecoms in the market, of which three dominated the market; namely Vodacom (M-Pesa), Tigo (Tigo-Pesa) and Airtel (Airtel money).

The registered mobile money accounts totalled 108.5 million, of which 33.1 million were active accounts transacting a total of US$ 49 billion in 2020 (BoT, 2021b). Dominance in the market explain rapid evolution of products in the market. For instance, leaders in the market in the likes of Vodacom-Tanzania are willing to invest in products or services banking on its wider network coverage and customer base, with expectation of quick returns before adoption of similar technology by competitors.

Role of Technology in BFSI

Challenges

While the digital transformation of Tanzanian banks has brought numerous benefits, it also comes with several challenges. Cyber Security is a significant concern. As banks digitize their services, they become increasingly vulnerable to cyber threats. According to a survey by Serianu, a Cyber Security consulting firm, Tanzanian organizations lost an estimated $85 million to cybercrime in 2022.

Furthermore, while digital banking has expanded financial inclusion, it raises concerns about digital inequality. As banks move their services online, customers without access to the internet or digital literacy skills risk being left behind. For example, while 3G mobile network coverage is 81% of Tanzania’s total population, only 26% is connected or uses 3G or 4G services.

There are also regulatory challenges, in which digital banking technology often outpaces regulatory frameworks, potentially creating gaps in oversight and consumer protection. Despite the challenges, the rewards are immense: improved financial inclusion, greater efficiency, and increased economic growth. It is a journey that requires commitment from all stakeholders – banks, customers, regulators, and the government. With a shared vision, Tanzania can successfully navigate the digital banking era, unlocking a future of financial prosperity for all its citizens.

However, the regulatory bodies, primarily the Bank of Tanzania, must evolve their regulatory frameworks to keep pace with technological advancements, protect consumers, and maintain the banking sector’s stability. Banks must enhance Cyber Security, improve user experience, and expand digital services. There is also a need to increase digital literacy among the population and ensure that digital banking services are accessible to all, regardless of their location or socio-economic status. Banks also need to use more of AI and data analytics in their operations.

Professor and Head, Department of Management Studies and Head, CAMS-IITM Fintech innovation Lab, Indian Institute of Technology Madras. (Koushik Hati, Research Scholar, Department of Management Studies, Indian Institute of Technology Madras)

Chennai 600036, INDIA | Email: mtm@zmail.iitm.ac.in