Subscribe and Get a Free Copy

Enter your details below to subscribe for free to our newsletter.

Enter your details below to subscribe for free to our newsletter.

Zanzibar is poised for remarkable economic growth in the 2024/2025 fiscal year, with a projected GDP increase of 7.2%. This optimistic forecast is complemented by an ambitious public revenue projection, set to rise from TZS 2.8 trillion in 2023/2024 to TZS 5.1 trillion in 2024/2025—an impressive 82.1% increase. This growth underscores the government’s strategic efforts to bolster the economy through various fiscal and economic measures.

The projected increase in revenue will stem from multiple sources. First and foremost, the inclusion of state-owned enterprises (SOEs) in the national budget is expected to contribute approximately TZS 202.6 billion. This step signifies the government’s willingness to tap into the resources and potential of SOEs to boost national revenue. However, this strategy embeds a “crowding out effect” whereby private investors may have disincentives to invest in these sectors. The rationale for establishing and supporting some of these corporations is no longer valid. The government should think about diluting its shares in these corporations by selling them to the private sector for purposes of increased efficiency and profitability.

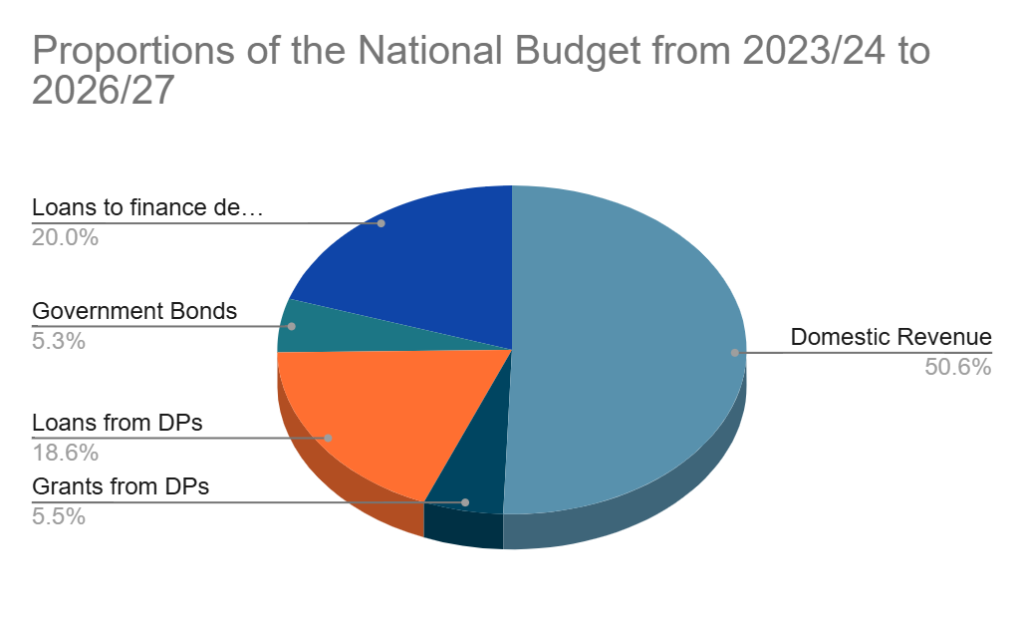

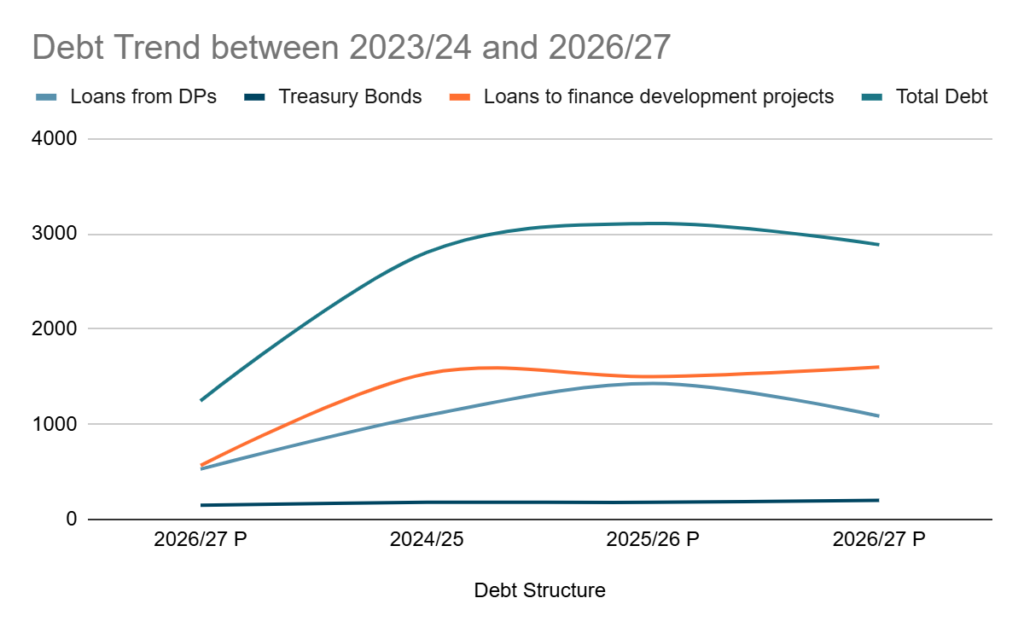

Secondly, the government plans to raise TZS 1.6 trillion in additional funds through increased borrowing to finance development projects. This strategic borrowing, though it increases national debt, is deemed necessary to fuel the ambitious development agenda.

Furthermore, financial support and concessional debt from development partners are projected to increase significantly, from TZS 686.61 billion to TZS 1.5 trillion. This substantial rise reflects the growing confidence of international partners in Zanzibar’s economic potential and strategic direction. Lastly, enhanced domestic revenue collection efforts are expected to see the tax-to-GDP ratio rise from 22.4% to 33%. This increase in domestic revenue collection is crucial as it reflects the government’s commitment to improving fiscal discipline and efficiency in revenue generation.

The national debt is projected to rise from TZS 1.2 trillion in 2023/2024 to TZS 2.8 trillion in 2024/2025. While increased borrowing is a leverage to fund development projects, it also reduces future fiscal flexibility. However, with the positive economic outlook and improved domestic revenue collection, the impact of this increased debt might not be felt in the short term. The government’s strategic approach to debt management, emphasizing the importance of using borrowed funds for productive investments, aims to ensure that the increased debt burden does not stifle economic growth.

Several new fiscal measures are being introduced to support economic growth. An excise duty on imported chicken and fish aims to promote domestic poultry and fishery industries, expected to collect TZS 3 billion. This measure is designed to protect and stimulate local industries, thereby reducing dependency on imports and encouraging self-sufficiency.

Another measure is an infrastructure levy of USD 10 per day for tourists staying in luxurious accommodations, expected to generate TZS 3.5 billion. This levy aims to capitalize on the tourism sector, ensuring that the benefits of tourism are reinvested into infrastructure development. Additionally, a new marine transportation tax will be charged to tourists traveling between Zanzibar and Dar es Salaam, projected to bring in TZS 1 billion. However, this measure raises concerns about dollarization, potentially reducing Zanzibar’s economic autonomy in monetary policy.

About 64% of the budget will be allocated to development projects, including the establishment of the Industrial Development Fund, an Investment Bank, and a Stock Exchange Market. These initiatives are promising, aiming to lay the foundation for long-term sustainable economic growth. However, the lack of efficient capital markets makes it challenging for local investors to play a visible role in financing these development projects.

The establishment of the Stock Exchange Market appears to be a critical step towards creating efficient capital markets through private investors. This is a classic textbook example on how to establish capital markets in developing economies, but it is not necessarily the right pathway at the moment. The Stock Exchange Market would require a relatively large companies to list their shares and issue corporate bonds, investors to trade them and sophisticated intermediaries to facilitate transactions. The size of Zanzibar’s economy and the strength of the private sector are not ready for establishing an active Stock Exchange Market.

To further stimulate economic growth, it is sensible that the government incentivise the private investors to create an open-ended Investment Fund, attracting diverse investors. This initiative aims to pool capital from local savers and investors, enabling small local investors to participate in financing domestic projects. By providing an alternative to traditional bank loans, this fund can have a broader positive impact on all economic sectors. Additionally, it will allow the government to borrow at lower costs, making it a more efficient way to raise funds for development. This approach not only democratizes investment opportunities but also ensures that the benefits of economic growth are more widely distributed.

To enhance the effectiveness of the budget, several suggestions have been put forward. Firstly, the government should clearly state the reductions and exemptions of VAT to help businesses understand their implications. This transparency is crucial for businesses to plan and strategize effectively, ensuring that they can take full advantage of the fiscal measures in place.

Secondly, there is a recommendation to reduce social security contributions for the private sector to encourage the formalization of informal businesses. Compared to other countries, Zanzibar’s mandatory social security contributions are relatively high, which discourages compliance. Lowering these contributions could incentivize more businesses to operate within the formal economy, thereby broadening the tax base and increasing revenue.

The 2024/2025 budget sets more realistic targets, with an estimated aggregate public revenue collection of TZS 5.1 trillion and a budget execution rate of 78%. This shows that the government is making more achievable budget plans. Increased domestic revenue collection and strategic use of public debt are crucial in filling funding gaps, ensuring that the budget aims to foster economic growth, involve the private sector in development, and manage fiscal and debt sustainability effectively.

Zanzibar’s 2024/2025 budget reflects a strong commitment to social and economic development through a strong private sector engagement. This is demonstrated by ambitious revenue projections and increased investment in economic, infrastructure and social projects. However, the success of these initiatives will depend on effective implementation, efficient management, and addressing inherent challenges pertain to both administrative and structural issues. This includes strengthening the national revenue management, modernizes public procurement processes, and improving resource allocation and audit effectiveness, in line with the measures by the Controller and Auditor General (CAG) earlier this year.

Without digital transformation, the ongoing significant investments to bring quick economic payoffs and quantifiable social returns may seem like trying to fit a square around the hole. The Zanzibar ICT Policy 2013 was developed to leverage the ICT infrastructure for improving public service delivery and revenue collection. The mission to improve the public revenue collection, to a large extent, has been realized based on the impressive growth of the national budget, as discussed above. This does matter a lot, but the key point, above all, is to have a digitally enabled government, society and economy, and in this area only limited progress has been made.

The pace of rapid changes in emerging technology, societal behavior and global interactions do influence Zanzibar. The government budget 2024/25 has included digital transformation, for the first time, in the list of the national top priorities. A transformation towards a digital nation, however, is a marathon and not a short sprint race. It is encouraging to see the government’s recognition of this reality by opting to develop the Zanzibar Digital Transformation Policy during 2024/25.

Basic economic rationale tells us that for Zanzibar to become a developed economy, it needs to accelerate the economic growth to be substantially higher above the population growth rate. Certainly, having a digital government, society and economy will accelerate Zanzibar’s aspiration to achieve inclusive and sustainable socio-economic development. Therefore, Zanzibar needs to create robust but flexible regulatory frameworks, guide development and adoption of emerging technologies by the private sector, improve multi sectoral coordination, and create a more enabling environment for innovation and the digital economy to thrive. Among other things, these elements are prerequisites for Zanzibar to attain digital transformation. In conclusion, Zanzibar’s 2024/2025 budget is a testament to the government’s strategic vision and commitment to economic growth. The projected economic growth of 7.2%, coupled with the revenue targets and strategic initiatives, underscores the government’s determination to transform Zanzibar’s economic landscape. While challenges remain, the budget’s largely focus on development projects, private sector inclusion, and improved fiscal management provides a robust framework for sustainable economic growth. The global community will be keenly observing how Zanzibar embarks on ambitious development and social investments presented by this year’s budget.

PhD Financial Economics (Investments,Corporation Finance, Public Finance & Social Security)

Email: twahir.mohammed@zrcp.org